January 2021. Gamestop, the American video game company that saw its shares rising up from $20 to $400 in less than two weeks. The dynamic has probably fed on the rise of risk appetite and pandemic boredom, in coincidence with a growing share of younger investors accessing stock trading opportunities through low cost trading platforms on investing apps. Gamestop became overpriced due to the online coordination of retail investors, started on a subReddit community called Wall Street Bets (WSB).

Equities experienced exceptional volatility related to social media hype

Although many researchers and

analysis of memestocks focus on WSB, data from other platforms and media outlets show that social

media dynamics around memestocks are broader than we thought.

In this project we focus on memestocks and their dynamics through:

- data on financial dynamics

- social media platforms (Reddit and Twitter)

- global news

We study the phenomenon retroactively and we try to build an alarm system based on anomaly detection.

Our data at a glance

| 20.000 newspapers |

18 financial stocks |

2 social networks |

1.700.000 tweets |

GameStop GameChanger

At the beginning of 2021, the stocks of GME looked like a terrible buy. For about a decade, in fact, the Game stop business had deteriorated. Millennials were abandoning the habit of buying video games, preferring to play streaming or downloading. Restrictions due to the Covid-19 pandemic dealt another blow to Gamestop's business, by forcing stores to close. Wall Street hedge funds seized the opportunity and began shorting these stocks, betting to make money if Gamestop's value fell.

However, in less than two weeks, the shares of the struggling company rose from just $20 to almost $500 (more than 2.000%). In a matter of days Gamestop became the first case of a "meme stock" that is, a company whose shares became overpriced due to the attention of social media and coordinated action of retail investors . This dynamic was not backed by good performance of its underlying business.

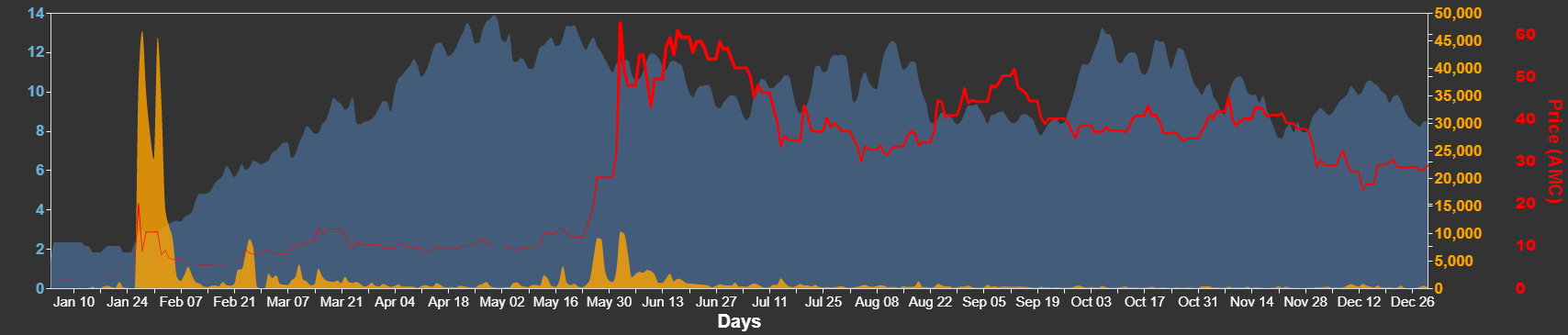

After Gamestop, other companies, such as the AMC movie theatre chain, also enjoyed rapid and seemingly unwarranted increases in their stock prices.

For the first time in history retail investors had an impact on the financial market, by coordinating on a virtual platform L. Longo

We interviewed economists Ilaria Gianstefani and Luigi Longo from the IMT School of Advanced Studies (Lucca, Italy) who started studying memestocks and published the paper The echo chamber effect resounds on financial markets: a social media alert system for meme stocks motivated by the novelty and exceptionality of the Gamestop event.

They think that GME case inaugurated memestocks as a new phenomenon due to the unprecedented

impact caused by retail investors – usually considered as noise traders.

Researchers across different disciplines are studying meme stocks.

They understand memestocks as a relevant innovation in economic behaviour: for the first time retail

investors organised on a virtual platform, by coordinating their activity, were able to cause an impact on

the financial market and create high instability.

SOCIAL MEDIA PUMPING

The whole Gamestop saga may have been manipulated by an expert of financial markets an analyst hiding behind the influencer name of DeepFuckingValue I. Gianstefani

The impact of retail investors has originated on Reddit, a network of communities where people

can participate in different groups – the subreddits – each one discussing a particular interest,

hobby or passion. Since the GameStop short squeeze, Reddit became renowned as an arena for self-organised

social media-driven investment behaviours. Fueled by members of the Reddit community, these investors decided

to flip the switch on large hedge funds that were shorting certain businesses, businesses that had a certain affective

value to the people, they claimed. As more retail investors joined in, the result was an acceleration of shares’ price,

a short squeeze — as short sellers bailout to cut their losses. Notwithstanding the popularity of this version of the story,

the experts we interviewed also advanced the hypothesis that the whole Gamestop event may have been manipulated by the expert

of financial markets, and analyst, hiding behind the influencer name of ‘DeepFuckingValue’.

AMC and GameStop were two prevalent names that caught fire on reddit, inciting an unprecedented number of newbie traders to invest.

After them, other companies also enjoyed web popularity and consequent investment behaviours.

But going viral has not led all stocks to a Gamestop-like effect. Why? That is where we step in.

As communities proliferated around the most disparate topics, many subreddits dedicated to

the financial market have popped-up. These communities work as incubators of online “hype” associated with stock prices.

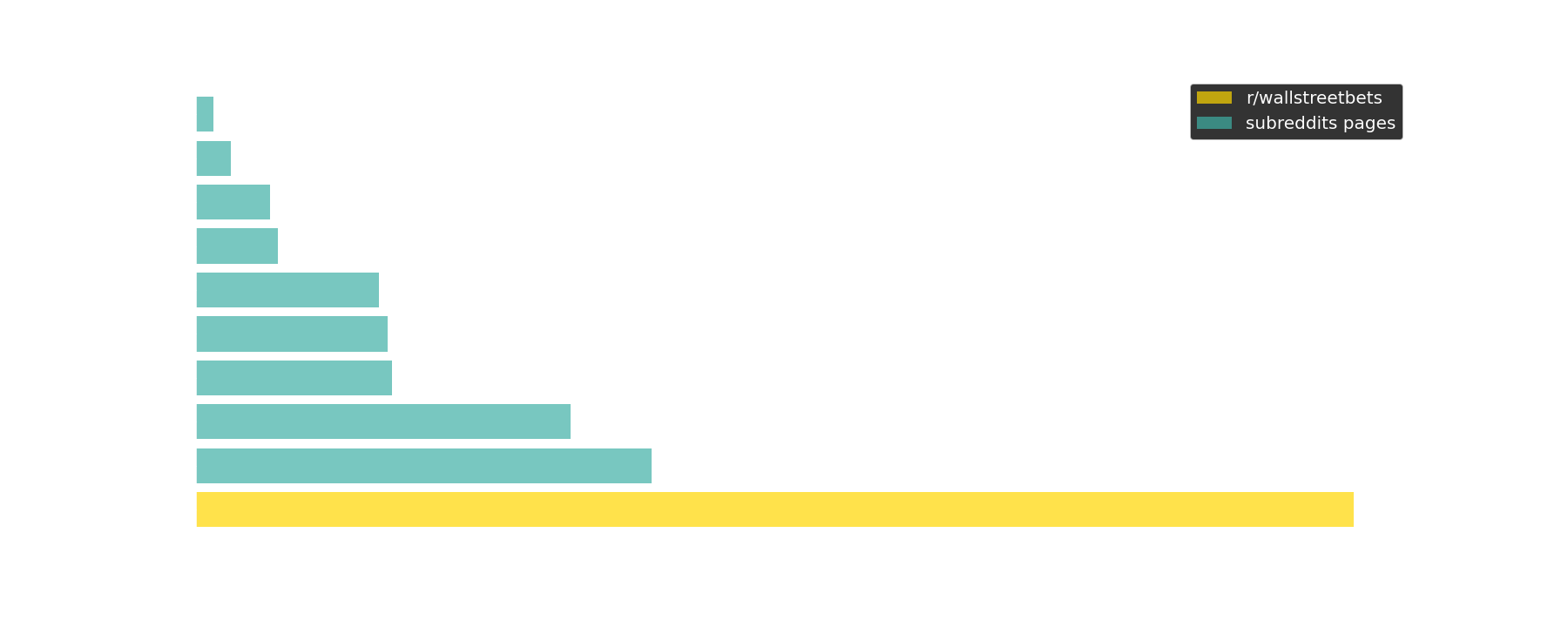

WallStreetBets is the most popular among them. With more than 12.000.000 subscribers, WSB is one

of the 55 biggest communities, overall.

As stocks gain visibility on Reddit, they are mentioned across different subreddits. The majority of popular stocks on Reddit mark their presence on four other communities, beyond WSB.

Not only on Reddit

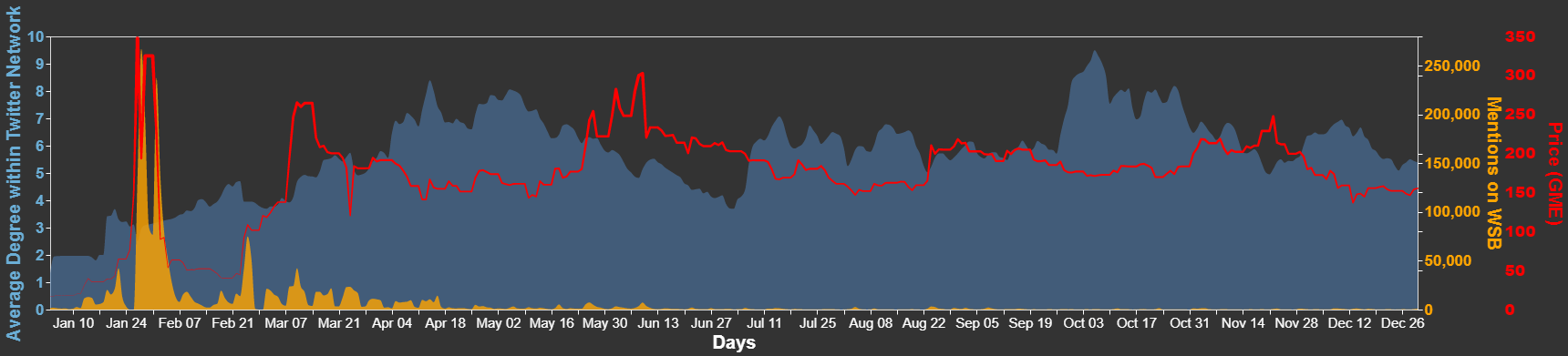

Soon enough, this “movement” had spillovers beyond the Reddit forum.

In the Gamestop case, the very same day Tesla CEO, Elon Musk, retweeted

a link to the r/wallstreetbets trading increased and the stock rose nearly

140 percent, in after-hours trading. Regarding GameStop and AMC theatre shares,

the Central Bank of America specifically noted that the volume and volatility of

those stocks might be related to high activity on Twitter.

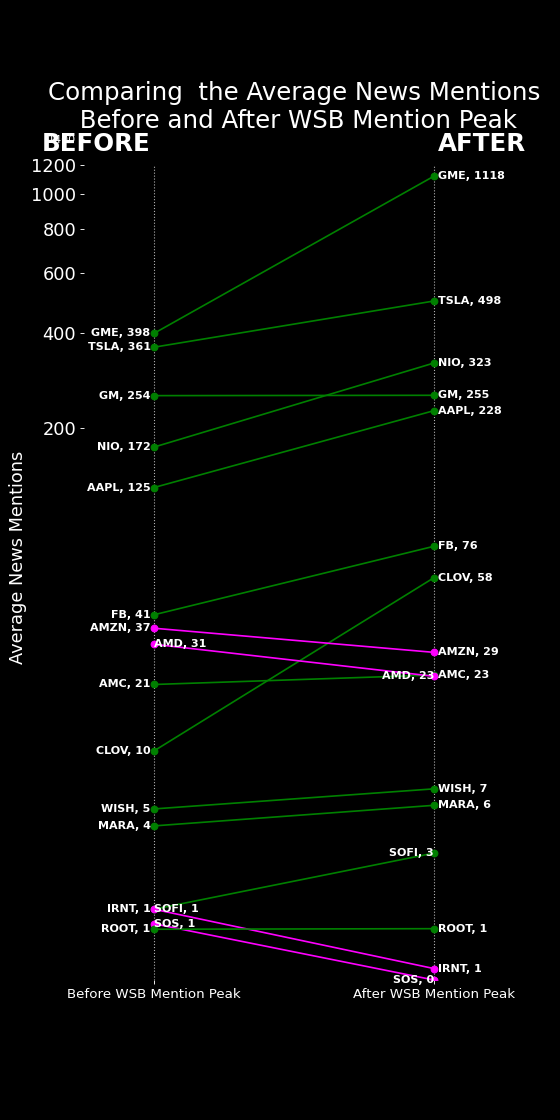

Online activity of WSB users’ is also related with the activity on more

traditional media outlets, such as newspapers. Cross-referencing data from

Reddit mentions and data from news articles across the world, we found that

the increased activity on the subreddit, measured in daily frequency of the stocks’

mentions, is positively correlated with the volume of press articles mentioning the company.

On days when a stock reaches maximum daily mentions on Wall Street Bets, the press does not reflect

social media positivity, though. On the contrary: articles mentioning the companies whose shares go

viral on Reddit tend to display an overall negative tone. While this observation does not allow any

categorical statements, this may be linked with a feature of meme stock events, highlighted by many

analysts.

A stock’s popularity on social media is usually unrelated to the positive performance of

the business and of the company's fundamentals. This fact reinforces a common criticism of Wall Street,

the excessive decoupling of the financial market from the “real economy”.

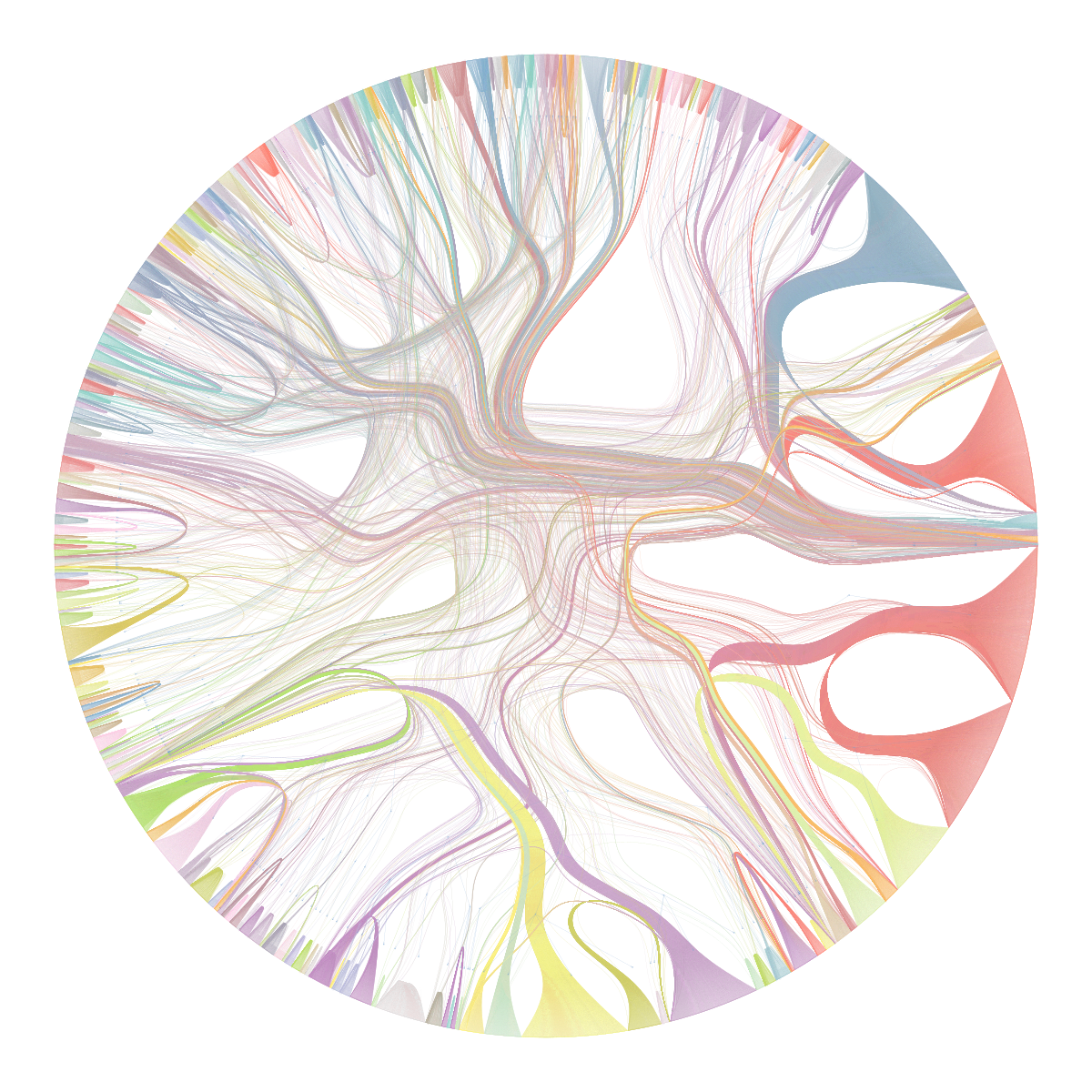

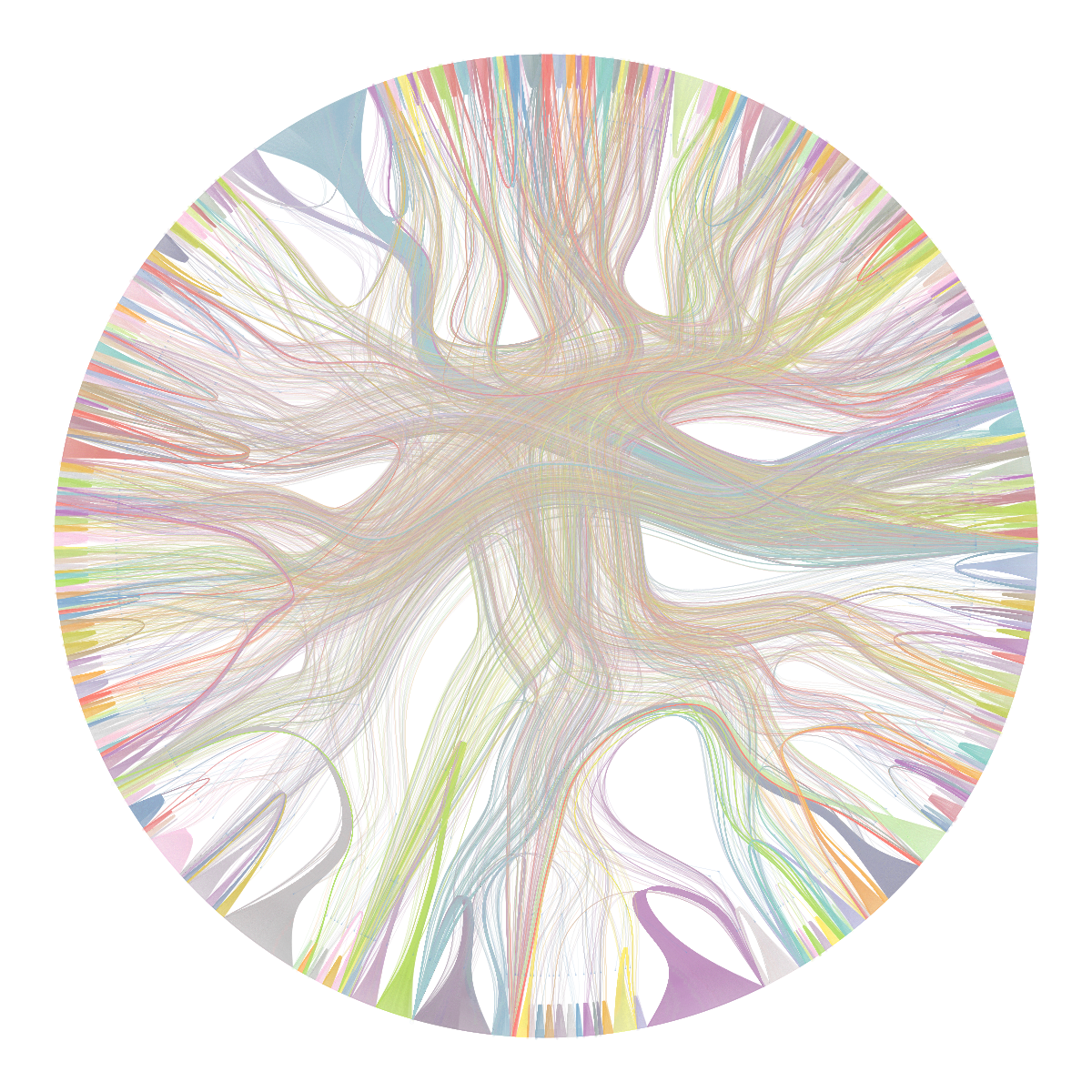

| GME | Nodes | Edges | Max node degree | Avg node degree | Assortativity |

|---|---|---|---|---|---|

| BEFORE | 19.836 | 27.890 | 5.143 | 2,96 | -0,18 |

| AFTER | 21.121 | 32.491 | 2.346 | 3,47 | -0,21 |

| WISH | Nodes | Edges | Max node degree | Avg node degree | Assortativity |

|---|---|---|---|---|---|

| BEFORE | 642 | 793 | 524 | 4,14 | -0,54 |

| AFTER | 1.397 | 2.583 | 1.145 | 5,92 | -0,61 |

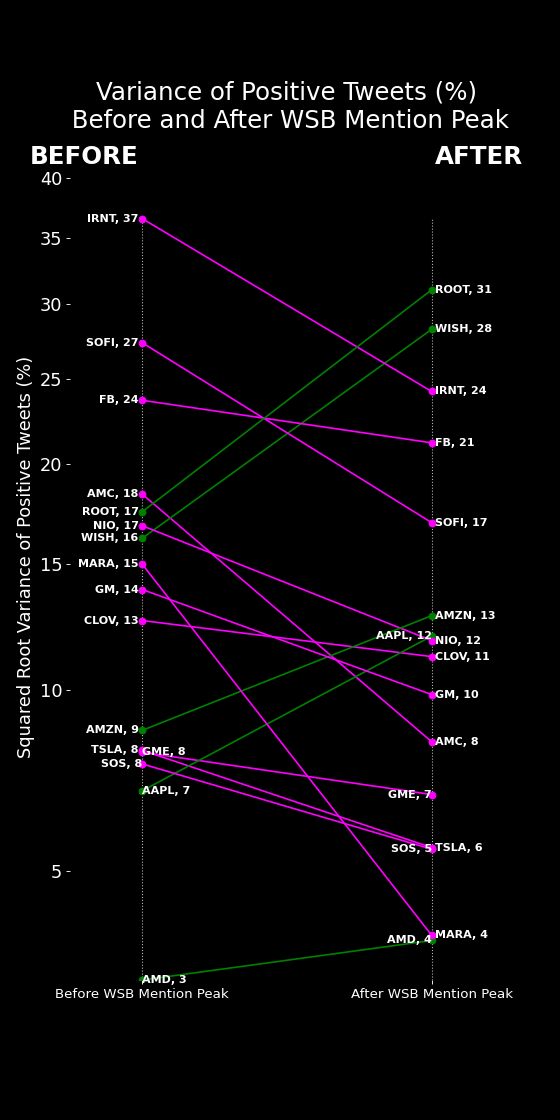

Wall Street Bets polarise sentiment on Twitter

On the day of maximum social network activity around a specific stock,

that is when there is a spike in mentions on WSB, on Twitter we found a

bigger percentage of positive tweets among those mentioning the ticker.

Only tweets mentioning GME display a prevailing negative

sentiment on days of mentions’ peak. Gamestop not only recorded the highest traded

volume in 2021, but also dragged animated debates. Committing users from different

social media outlets, these discussions agglutinate a heterogenous plethora of voices

and opinions, which eventually took diverging positions, sometimes extrapolating Wall

Street and the financial market, flirting with populist tones, when not lapsing into

hate speech and even antisemitism. Given the exceptional polarisation of discourse

around GameStop one can possibly understand the amount of negative tweets and the

lack of a significant difference among positive and negative tweets per day.

We also analysed tweet sentiment in relation to activity on Reddit. Data suggest a correlation

between maximum activity on Reddit and the stabilisation of positive tweets’ statistical behaviour.

Posts who show different tones, after the peak polarise toward a shared, not much variable, sentiment.

MEMESTOCK OR NOT MEMESTOCK?

Social media mentions, mainstream media coverage and online discussion polarisation may be responsible for the ‘hype’

around a stock. But this is not the only factor for a company share to become a meme stock. Gamestop came to be considered

as a paradigmatic case, but not every stock popular on Reddit displays similar repercussions on volume, price dynamics

and volatility.

Although the American financial authority reported that a meme stock is characterised by “the convergence of large price moves,

large volume changes, large short interest, frequent mentions on social media, and significant coverage in mainstream media”

(SEC, 2021), the interaction of these factors and their reciprocal significance have not been explored so far.

Thus, while dealing

with such an undefined phenomenon and large amounts of data, we used machine learning unsupervised techniques to look for meaningful

groups among the stocks selected for this work.

In the identification of different groups the most discriminant features confirmed to be related to social media activity

and interest, to Wall Street Bet and its echo across other platforms such as other subreddits and even Twitter.

Also relevant is the incidence of financial data: the presence of short sales percentage among most relevant variables

supports the fact that the meme stock phenomenon involves stocks which are often considered bad deals and therefore shorted.

We tried different algorithms and all resulted in the same cluster division.

Among the stocks who gained visibility online three separeted groups have been identified: one is composed only by GME and AMC, which are also widely recognized as paradigmatic cases.

A second group reunites the shares of companies that went viral but hardly ever exceeded

the anomaly price return threshold that we fixed to be 50% within 10 consecutive days. Most of them are well-known companies

(Facebook, Tesla, Apple), that have high capitalization and whose productive activities are not in a bad shape as those shorted.

Finally, a third group (e.g. Ironnet inc., SoFi Technologies, Root Inc) reunites smaller companies with

lower market capitalization and thus more prone to crowd pumping dynamics. In fact, during 2021, most of them experienced at least

a period of high volatility on stock price due to social activities.

TO THE MOON!

We collected a huge amount of daily data. We want to try to answer one last question: are these data relevant enough to build an effective predictive model?

The alert signal must be triggered as soon as the 50% cumulative price return threshold is expected to be exceeded in the next 10 days. For this purpose, we trained some traditional models (Logistic Regression, Ridge Classifier, LDA, Linear SVC, Random Forest Classifier) on a training set consisting of the 16 tickers analysed.

We prefer high precision (that means no wrong investments) rather than high recall.

The best performing model resulting after cross validation and hyperparameter tuning on the training set is a Random Forest Classifier.

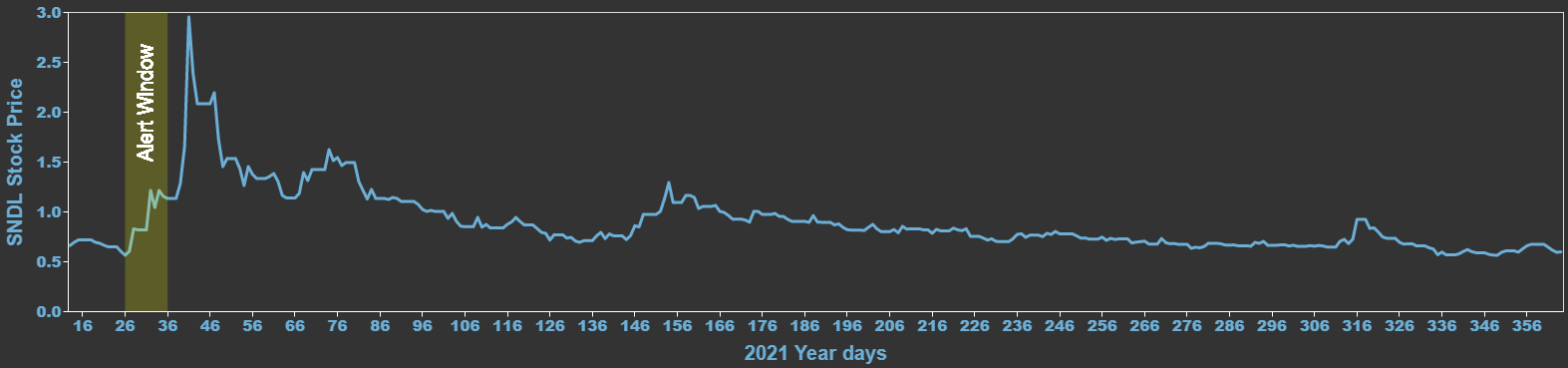

For the test set, we have selected two other tickers among the most cited ones in WSB: SNDL (Sundial Growers Inc) and

LCID (Lucid Motors). They both registered anomalous stock price raises during 2021.

Results aren't great, but still good with an overall 95% accuracy, 100% precision and 6% recall.

In fact, although the trained model is not able to detect any of the LCID anomalies, we have two matching

alert for SNDL that would have meant an at least 50% ROI and that span from a "buy" signal on the 26th day

to a "sell" signal within the 36th day.

We are missing the real peak, however this is a good start.

Acknowledgements

We thank Ilaria Gianstefani and Luigi Longo (IMT, Lucca), for being our experts interviewees for this piece, and also for exchanging interesting ideas and sharing experience. We thank the authors of YoloStocks.live for the access to their data under the CC By 4.0 license.

About us

Gwydyon Marchelli

Researcher as a hobby. My real work is to play D&D and board games with my parents

Olga Cozzolino

Materials: 50% statistics and data visualization, 50%... a gaussian with mean on good times and parties